A bank verification letter, also known as a bank confirmation letter or bank reference letter, is a document issued by a financial institution that verifies the authenticity and accuracy of an individual or entity’s financial information. This letter serves as a confirmation of the account holder’s financial standing, account details, and transaction history. It is often requested by third parties, such as employers, government agencies, or lenders, as a means of validating financial information provided by the account holder. In this article, we will explore the purpose and significance of a bank verification letter, its key components, and how it contributes to ensuring trust and reliability in financial transactions.

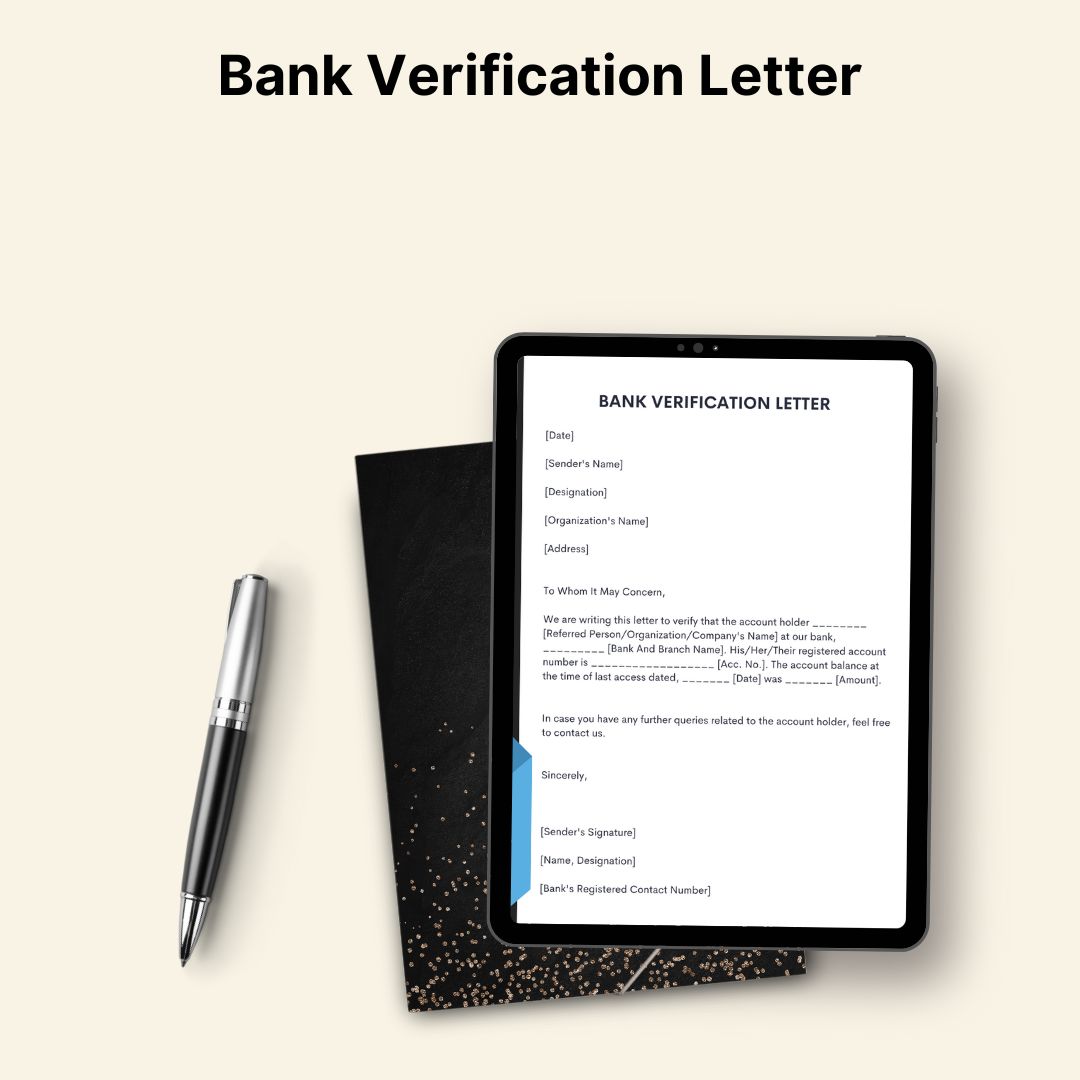

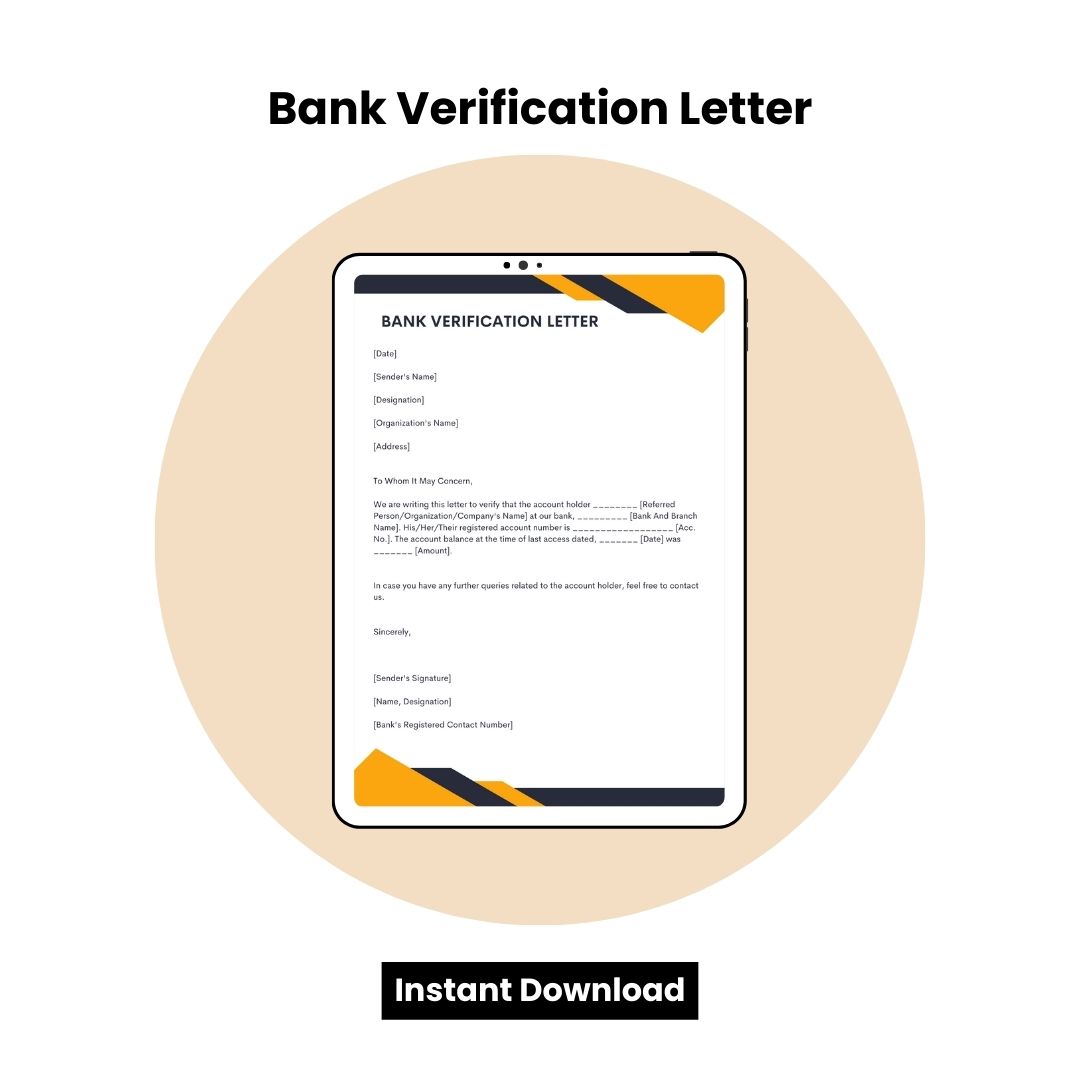

Printable Bank Verification Letter

- Verification of Financial Information: A bank verification letter plays a crucial role in verifying the accuracy and authenticity of financial information provided by an individual or entity. It provides third parties with assurance that the financial details, such as account balances, transactions, and account ownership, are verified by the financial institution.

- Trust and Reliability: By providing a bank verification letter, financial institutions contribute to building trust and reliability in financial transactions. Third parties can rely on the information provided in the letter, knowing that it has been authenticated by the bank and is based on actual account records.

- Compliance with Legal and Regulatory Requirements: Certain legal or regulatory processes require the submission of a bank verification letter to validate financial information. For example, when applying for a loan or mortgage, the lender may request a bank verification letter to assess the borrower’s financial capability and creditworthiness.

- Facilitation of Financial Transactions: A bank verification letter simplifies and expedites financial transactions by providing reliable and verifiable information. It eliminates the need for third parties to independently verify financial details, reducing administrative burdens and ensuring the smooth processing of transactions.

Sample Bank Verification Letter in PDF & Word

- Bank Information: The letter should include the full name, address, contact information, and logo of the financial institution. This information establishes the authenticity of the letter and enables recipients to contact the bank for further verification if needed.

- Account Holder Information: The letter should specify the full name and contact details of the account holder. This ensures that the letter is specific to the individual or entity in question and provides a reference for further verification.

- Account Details: The letter should include specific account details, such as the account number, type of account (e.g., savings, checking), and date of account opening. These details establish the existence of the account and provide essential reference information.

- Verification of Balances: The letter should state the current balance or balances of the account(s) in question. This verifies the financial position of the account holder and provides accurate information on available funds.

- Transaction History: The letter may include a summary of recent transactions or provide a transaction history for a specific period. This information gives an overview of the account activity and validates the account holder’s financial transactions.

- Confirmation of Account Ownership: The letter should confirm the account holder’s ownership of the account(s). This may include verifying the account holder’s name and address, as well as any other identification details provided by the account holder.

- Contact the Bank: To obtain a bank verification letter, the account holder should contact their bank directly. Banks have specific procedures in place for issuing such letters, and the account holder may need to provide certain information or complete necessary forms.

- Provide Necessary Information: The account holder should be prepared to provide the required information, such as their full name, account number(s), and the purpose for which the bank verification letter is being requested. Clear communication with the bank ensures that the letter includes the necessary details.

- Allow Sufficient Time: Banks may require some time to process and issue the bank verification letter. Account holders should allow for this processing time and plan accordingly to ensure they receive the letter within the required timeframe.

- Review the Letter: Once the bank verification letter is received, the account holder should review it for accuracy and completeness. If any discrepancies are found or additional information is needed, the account holder should contact the bank for clarification or correction.

Conclusion

Financial institutions contribute to the integrity of financial transactions by issuing accurate and verifiable bank verification letters. Account holders can rely on these letters to facilitate processes such as loan applications, employment verifications, or legal transactions. By ensuring the accuracy and authenticity of financial information, a bank verification letter serves as a vital document in establishing trust and maintaining the integrity of financial systems.

Reviews

There are no reviews yet.