501c3 Donation Receipt: Nonprofit organizations play a vital role in addressing social, cultural, and humanitarian issues. These organizations rely on the support of donors to continue their important work. To facilitate smooth and transparent donation processes, 501(c)(3) organizations often provide donation receipts to their contributors. A 501(c)(3) donation receipt template serves as a standardized document that not only acknowledges the donor’s generosity but also enables them to claim tax deductions. In this article, we will explore the significance of 501(c)(3) donation receipts and provide insights into creating an effective template.

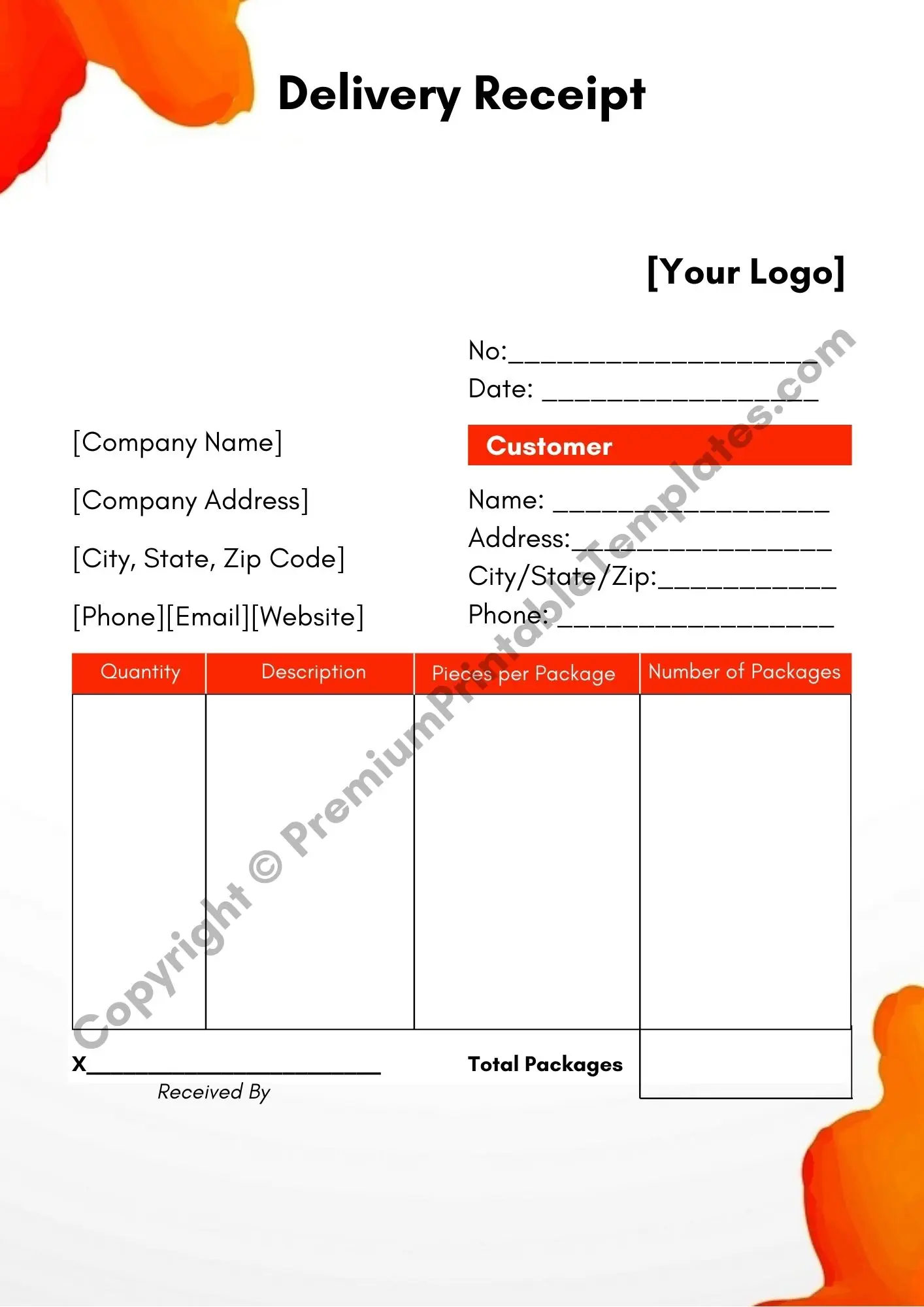

Printable 501c3 Donation Receipt

Acknowledgment of Donation: A donation receipt serves as an official acknowledgment from the nonprofit organization to the donor. It expresses gratitude for their contribution and reaffirms the impact of their support. This acknowledgment helps establish and strengthen relationships with donors, encouraging future contributions.

Tax Deductibility: Donors who contribute to eligible 501(c)(3) organizations can often claim tax deductions for their charitable contributions. However, to avail themselves of this benefit, donors must have proper documentation in the form of donation receipts. The receipt should contain essential information required by the Internal Revenue Service (IRS) to validate the tax deductibility of the donation.

Compliance with Legal Requirements: Nonprofit organizations are subject to certain legal obligations, including maintaining accurate financial records and providing receipts for tax-exempt donations. By issuing donation receipts, organizations demonstrate their compliance with these requirements and build trust with donors and regulatory authorities.

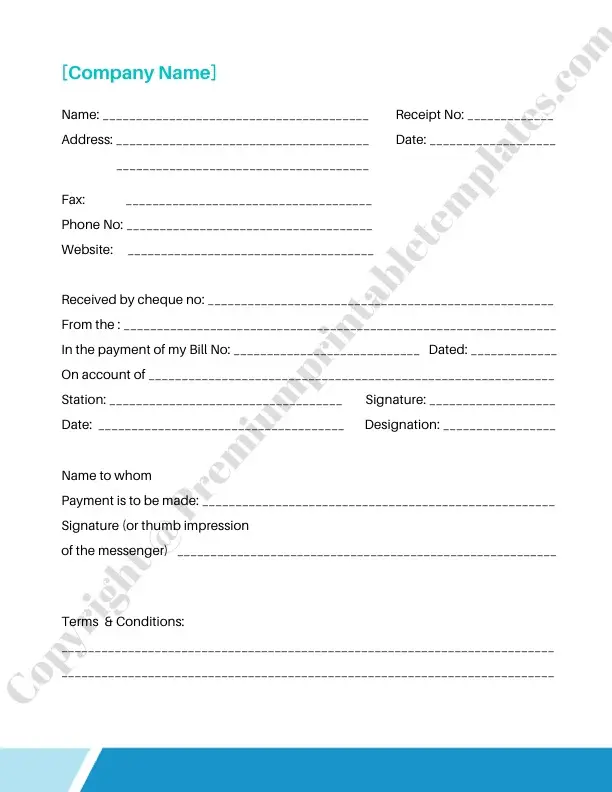

Blank 501c3 Donation Receipt in PDF & Word

Nonprofit Organization Information: The template should include the legal name, address, and contact details of the nonprofit organization. This information helps identify the organization and establishes its legitimacy.

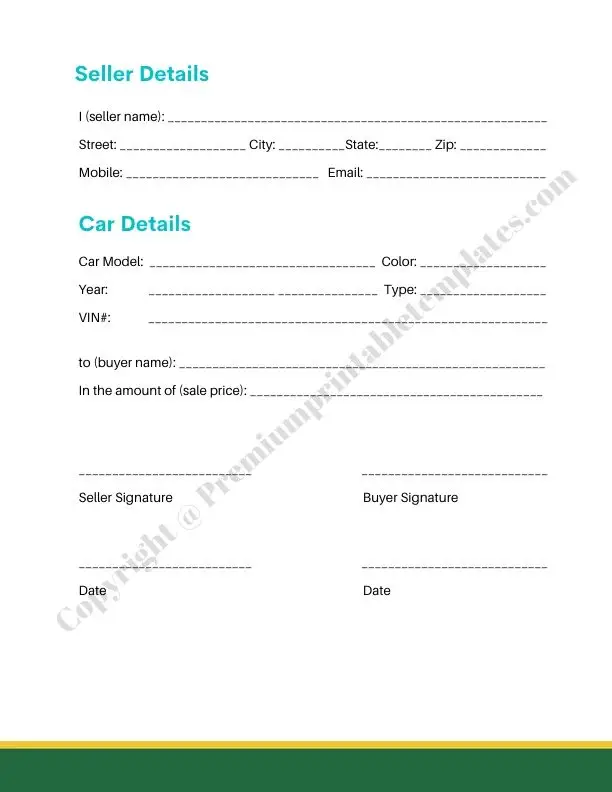

Donor Information: The receipt should include the donor’s name, address, and contact details. This ensures that the receipt is properly linked to the specific donation and allows the donor to claim tax deductions.

Donation Details: The receipt should clearly state the date of the donation, the amount contributed, and the form of the donation (cash, check, or in-kind). Including a unique donation reference number can be helpful for record-keeping purposes.

Tax-Exempt Status: The receipt should mention the tax-exempt status of the nonprofit organization, such as its 501(c)(3) status. This information confirms to the donor that their contribution is eligible for tax deductions.

Signature and Contact Information: The receipt should be signed by an authorized representative of the nonprofit organization. Additionally, it should provide contact information for any further inquiries or clarifications.

Use a Professional Template: It is essential to use a well-designed and professional-looking template that reflects the organization’s branding. Various software programs and online platforms offer customizable receipt templates that can be tailored to suit the organization’s needs.

Ensure Clarity and Readability: The receipt should be easy to read and understand. Use clear and concise language to describe the donation details, and avoid technical jargon whenever possible. Organize the information in a logical and coherent manner to facilitate quick reference.

Maintain Compliance with Legal Requirements: Familiarize yourself with the tax regulations and reporting requirements specific to your jurisdiction. Ensure that the template includes all the necessary information required for tax compliance, such as the organization’s Employer Identification Number (EIN) and a statement confirming that no goods or services were provided in exchange for the donation, if applicable.

Incorporate Branding Elements: While maintaining compliance, add branding elements such as the organization’s logo, tagline, and color scheme to create a consistent visual identity. This helps reinforce the organization’s image and fosters brand recognition.

By using a well-designed and informative template, nonprofits can simplify the donation process, comply with legal requirements, and strengthen their relationships with donors. With the right template, nonprofits can ensure transparency, accountability, and efficiency in their fundraising efforts, contributing to the greater good of society.

Reviews

There are no reviews yet.